Build Business Credit with Your EIN — Not Your SSN

Choose the plan that fits your business goals and start building credit that protects your personal assets.

Choose Your Business Credit Building Path

Select the program that best fits your business goals and timeline.

MOST POPULAR

8 Monthly Payments

BEST DEAL

One Payment

Best value - pay once and save

Everything You Need to Build Business Credit

Both plans include comprehensive tools and resources to establish your business credit profile.

Fundability System

Step-by-step guidance to ensure your business meets all lender requirements for credit approval.

Fundability Checks

Comprehensive analysis of your business to identify and fix any issues that could prevent credit approval.

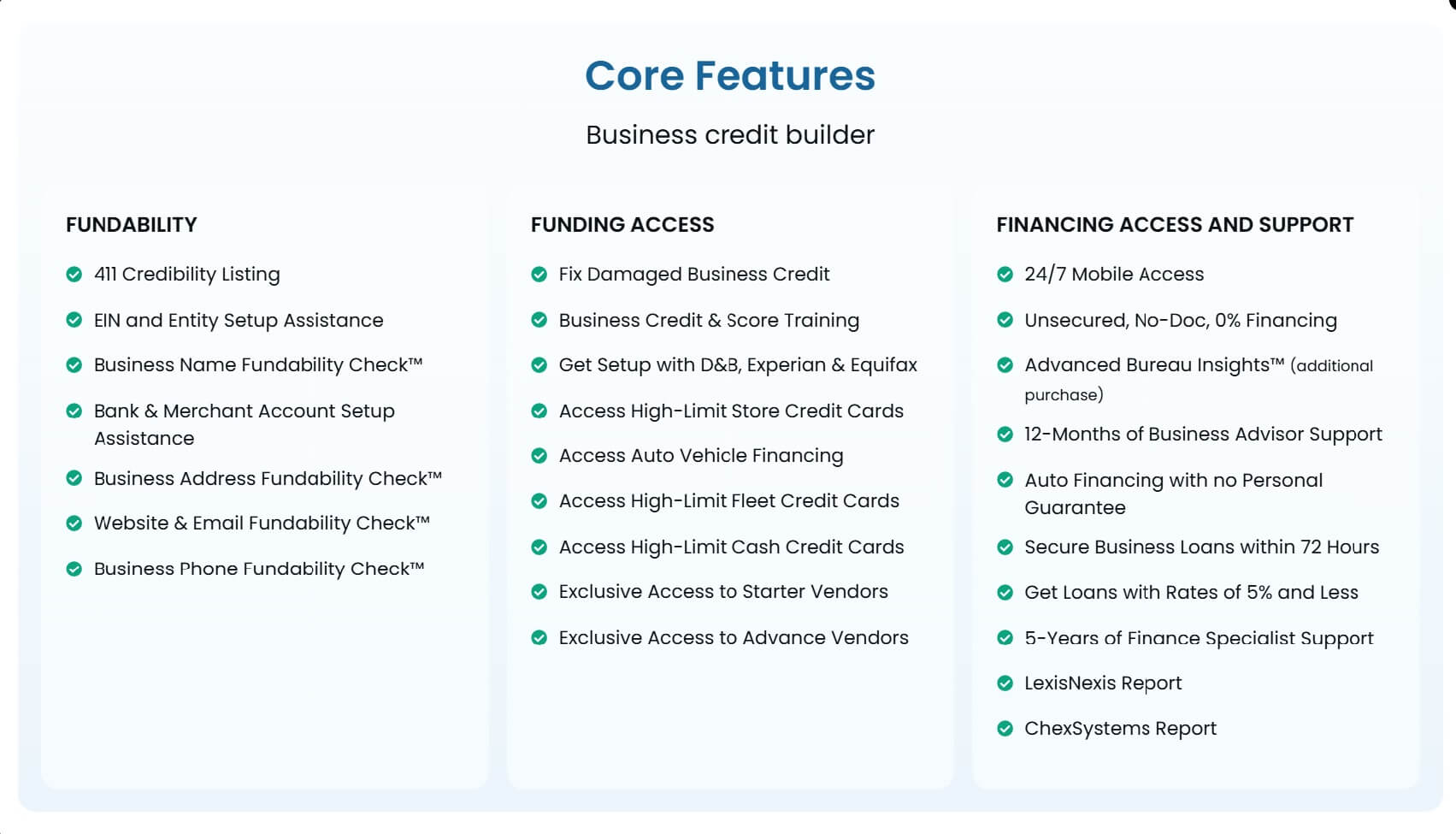

Business Credit Builder

Access to vendor accounts and credit sources that report to business credit bureaus.

Funding Access

Direct connections to lenders and credit sources that approve based on business credit, not personal.

Cash Flow Monitoring

Beta access to tools that help you track and optimize your business cash flow for better credit management.

Bureau Insights Access

Add-on access to detailed reports from Dun & Bradstreet, Experian Business, and Equifax Commercial.

Frequently Asked Questions

Everything you need to know about our business credit building program.

What's the difference between business and personal credit?

How long does it take to build business credit?

Do I need an existing business to start?

Will my personal credit affect my ability to build business credit?

What types of businesses qualify for your program?

What's included in the program?

What is your refund policy?

Ready to Build Your Business Credit?

Join thousands of business owners who have successfully built business credit without personal guarantees.

1. Choose Your Plan

Select the program that best fits your business needs and timeline.

2. Get Instant Access

Immediately access our complete Fundability System and resources.

3. Start Building

Begin the step-by-step process to establish your business credit profile.

Questions? Call us at (888) 555-7890 or email info@evocredit.com